The Greek Development Law 4887/2022 of the Ministry of Development and Investments with the Title “Development Law – Greece Strong Growth” defines the conditions for inclusion as well as the framework for establishing schemes for state aid granting.

The Law introduces thirteen (13) new aid schemes which will allow the business community to design, develop and implement its initiatives with significant and modern forms of investment in all sectors of the Greek economy. Three fixed cycles for the submission of investment proposals are included, with a timeframe of maximum 60 days from the submission of an investment plan until its evaluation and inclusion in the corresponding scheme.

Conditions for State Aid

Investment plans and projects that fall under current aid schemes must be of an integrated initial investment nature according to Article 2, Point 49 of Commission’s (EU) General Exemption Regulation (GER) 651/2014 and in particular meet one of the following conditions:

- Creating a new Unit

- Expansion of existing Plant Capacity

- Production’s Diversification for Products or Services that have not been ever produced by the Unit, provided that the eligible costs exceed by at least two hundred percent (200%) the book value of the reused assets recorded in the fiscal (tax) year preceding the application for investment project’s inclusion to the beneficial provisions of the new Development Law.

- Fundamental Change of Unit’s entire Production Process, provided that, the eligible costs must exceed the depreciation during the three (3) previous fiscal (tax) years of those assets related to the activity that is to be modernized.

If the depreciation related to the above activity is not clearly reflected by the submitted financial data, this significant condition is not satisfied.

Investment Projects of all sectors of the economy are eligible to fall under the beneficial provisions of Law 4887/2022. Exceptions are made for Investments of Business Activity Codes included in the “National Nomenclature of Economic Activities Business Activity Codes 2008”, as well as Investment Projects that are implemented in one of the following:

- The steel sector

- The synthetic fibers sector

- The coal sector

- The shipbuilding sector

- The production, distribution and energy infrastructure sector

- The transportation sector (and related infrastructures)

Beneficiaries

The eligibility of Companies that fall under the beneficial provisions of the new Law is determined by specific criteria, among which it is a prerequisite that the Company shall be established in Greece or have a branch in the Greek Territory at the time of the Investment Project’s initiation.

Given the above, below are the forms of eligible Companies:

- Commercial Companies

- Cooperatives

- Social Cooperative Enterprises under Law 4019/2011 (A’216), Agricultural Cooperatives

- Producer Groups, Rural Partnerships under Law. 4384/2016 (A ‘ 78)

- Under Establishment or Merging Companies, with the obligation to have completed disclosure procedures before beginning operations on the Investment Project

- Enterprises operating under Consortium – Joint Ventures provided that they registered in the General Electronic Commercial Registry (G.E.MI. – ΓΕΜΗ)

- Public and Municipal Companies and their Subsidiaries upon specific conditions

Companies that meet specific criteria shall not fall under the Law’s beneficial provisions under certain conditions.

Financial Contribution – Self Participation

The financial contribution of each entity to the cost of the investment plan can be covered either with own funds or with external financing, provided that twenty-five percent (25%) of this assisted cost does not contain any state aid, public support or provision.

Covered Investment Projects

- Digital and Technological Business Transformation

- Green Transition – Environmental Business Upgrade

- New Business

- Fair Development Transition

- Research and Applied Innovation

- Agro-food, Primary Production and Processing of Agricultural Products, Fisheries

- Manufacturing – Supply Chain

- Business Extroversion

- Support for Tourism Investments

- Alternative Forms of Tourism

- Large Investments

- European Value Chains

- Entrepreneurship 360o

Types of Aid

The following types of aid are being provided:

- Grants – Free Provision of Funds by the State for covering partially the aided Investment’s Eligible Expenses

- Subsidy of Leasing by the State, covering part of the disbursed leasing installments for the acquisition of new mechanical and other equipment for a time period not exceeding seven (7) years

- Subsidy of Employment Cost, (Art.2, Par.31 BGER), for employment created by the investment for a time period not exceeding two (2) years

- Tax Exemption up to a certain percentage of the total investment cost and mechanical equipment. The entity can utilize the whole of the entitled aid of tax exemption within fifteen (15) fiscal years from the fiscal year of entitlement of the benefit of use under restrictions that apply cumulatively.

- Fixed Corporate Income Tax Rate for a period of 12 years from the completion of the Investment Project, exclusively for Investment Projects of major funding size

- Funding of Corporate Risk through Funds of Funds

Aid Rates

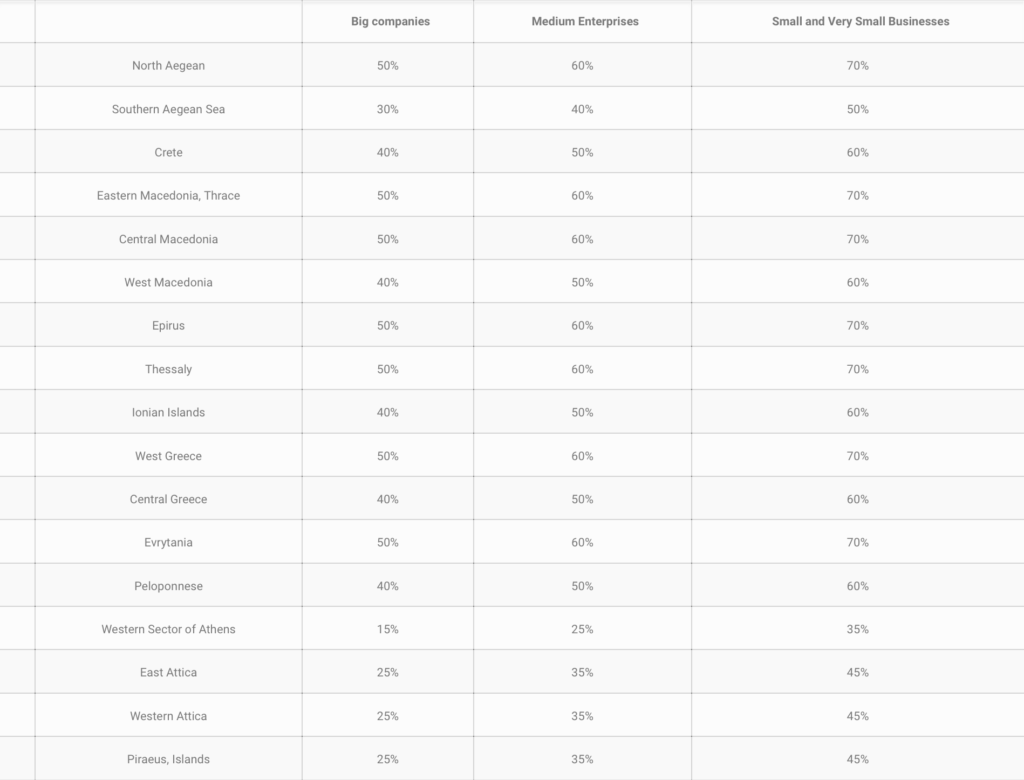

The aid intensity is the maximum amount of state aid that can be granted per beneficiary, and is expressed as a percentage of the selected investment costs. The competent European Commission has issued the guidelines for the national regional lines of character of the Member States to assess the compatibility of all regional aid notifications (RCA) to be granted. The territory of Greece consists of 13 NUTS 2 regions. In accordance with Annex I of the CGIP, twelve of these regions are eligible for aid under Article 107(3)(a) TFEU (“a” regions).

Below is the REGIONAL AID MAP OF GREECE FOR THE PERIOD 1.1.2022 – 31.12.2027, which shows the maximum aids depending on the size of a business.

Eligible Expenses of Regional Aids

- Investment costs for tangible assets

- Investment costs for intangible assets

- Salary cost of new employment created

Eligible Expenses Outside Regional Aids

Eligible costs outside R.A. include costs that can be aided by regional aids and are described in detail in APPENDIX B of the Development Law:

- Investment expenses for consulting services for SMEs (article 18 G.A.K.).

- Start-up costs for start-up companies and small and micro enterprises under establishment (article 22 GER).

- Expenditures for research and development projects (article 25 GER).,

- Innovation costs for SMEs (article 28 GER).

- Expenditures for procedural and organizational innovation for SMEs and Large Enterprises (article 29 GER).

- Investment expenses for the protection of the environment (article 36 GER).

- Investment costs for energy efficiency measures (article 38 GER).

- Investment costs for cogeneration of high efficiency energy from RES (article 40 GER)

- Expenditures for energy production from renewable sources (article 41 GER).

- Expenditures for installation of efficient district heating and cooling systems (Ar 46 GER).

- Expenditures for the restoration of contaminated areas (article 45 GER).

- Expenditures for recycling and reuse of waste (article 47 GER).

- Expenditures for vocational training (article 31 GER).

- Aids for SME participation in trade fairs (Article 19 GER).

- Aids for disadvantaged employees

Minimum Budget per Investment Project

- For big enterprises 1.000.000,00 Euros

- For middle enterprises 500.000,00 Euros

- For small enterprises 250.000,00 Euros

- For micro enterprises 100.000,00 Euros

- For cooperatives 50.000,00 Euros

- Expenditures for the restoration of contaminated areas (article 45 GER).

- Expenditures for recycling and reuse of waste (article 47 GER).

- Expenditures for vocational training (article 31 GER).

- Aids for SME participation in trade fairs (Article 19 GER).

- Aids for disadvantaged employees

Limitations

The total amount of aid per submitted Investment can reach up to 10.000.000,00 Euros.

The aid provided to each Entity, including aid to cooperating or affiliated Companies, may not exceed a cumulative amount of 20 million Euros for an individual Company and 30 million Euros for all affiliated and cooperating Companies, subject to certain restrictions.

The maximum limits are increased by 50% in case the aid is provided as tax exemption, with the exception of what is specifically defined in the “Fair Development Transition” regime.

These restrictions apply to Investment Projects subject to the provisions of the Law and for a period of three (3) years from the application of the Company.

For more information, click here