New Development Law – Greece Strong Growth

The Greek Development Law 4887/2022 of the Ministry of Development and Investments with the Title “Development Law – Greece Strong Growth” defines the conditions for inclusion as well as the framework for establishing schemes for state aid granting.

The Law introduces thirteen (13) new aid schemes which will allow the business community to design, develop and implement its initiatives with significant and modern forms of investment in all sectors of the Greek economy. Three fixed cycles for the submission of investment proposals are included, with a timeframe of maximum 60 days from the submission of an investment plan until its evaluation and inclusion in the corresponding scheme.

In an effort to speed up the procedures, additional arrangements will be made for evaluating, including the investments in aid schemes and monitoring the implementation, so as to ensure that implementation is accelerated through the assignment of the evaluation of the integration and monitoring of the implementation to a private certified auditor.

The Project’s supervision will last until the completion of the Investment.

General Remarks

- Reference is made to the provisions of the General block exemption Regulation (“G.B.E.R.”) of the European Commission (651/17.07.2014, L. 187/1/26.06.2014)

- The new Law is structured into two sections: (a) the General Section, which includes the main regulations and restrictions of the G.B.E.R. and refers to all aid schemes, and (b) the Special Section, which describes the specific aid schemes, to which the provisions of the General Part and of the G.B.E.R. are applied.

- Special categories of aid are being determined, either (a) on the basis of the performance of the companies (extroversion, mergers, employment increase, sectors, high added value), or (b) on territorial basis (highland, border areas and areas with increased migration burden, Industrial Areas, Innovations Zones). Companies that fall under the special categories may be reinforced through capital aids, in case the latter are not provided, or by additional capital aids, in case the latter are provided.

Beneficiaries

The eligibility of Companies that fall under the beneficial provisions of the new Law is determined by specific criteria, among which it is a prerequisite that the Company shall be established in Greece or have a branch in the Greek Territory at the time of the Investment Project’s initiation.

Given the above, below are the forms of eligible Companies:

- Commercial Companies

- Cooperatives

- Social Cooperative Enterprises under Law 4019/2011 (A’216), Agricultural Cooperatives

- Producer Groups, Rural Partnerships under Law. 4384/2016 (A ‘ 78)

- Under Establishment or Merging Companies, with the obligation to have completed disclosure procedures before beginning operations on the Investment Project

- Enterprises operating under Consortium – Joint Ventures provided that they registered in the General Electronic Commercial Registry (G.E.MI. – ΓΕΜΗ)

- Public and Municipal Companies and their Subsidiaries upon specific conditions

Conditions for State Aid

Investment plans and projects that fall under current aid schemes must be of an integrated initial investment nature according to Article 2, Point 49 of Commission’s (EU) General Exemption Regulation (GER) 651/2014 and in particular meet one of the following conditions

- Creating a new Unit

- Expansion of existing Plant Capacity

- Production’s Diversification for Products or Services that have not been ever produced by the Unit, provided that the eligible costs exceed by at least two hundred percent (200%) the book value of the reused assets recorded in the fiscal (tax) year preceding the application for investment project’s inclusion to the beneficial provisions of the new Development Law.

- Fundamental Change of Unit’s entire Production Process, provided that, the eligible costs must exceed the depreciation during the three (3) previous fiscal (tax) years of those assets related to the activity that is to be modernized.

If the depreciation related to the above activity is not clearly reflected by the submitted financial data, this significant condition is not satisfied.

Terms and Prerequisites for Participation

The financial contribution of each entity to the cost of the investment plan can be covered either with own funds or with external financing, provided that twenty-five percent (25%) of this assisted cost does not contain any state aid, public support or provision.

Covered Investment Projects

The Investment Projects that are covered by the new Law relate to all economic sectors, apart from certain exceptions (i.e. steel, coal, synthetic fibers, shipbuilding, etc.).

The Law aims to promote the economic development of the country by providing incentives to specific activities and Priority Sectors, depicted below:

- Digital and Technological Business Transformation

- Green Transition – Environmental Business Upgrade

- New Business

- Fair Development Transition

- Research and Applied Innovation

- Agro-food, Primary Production and Processing of Agricultural Products, Fisheries

- Manufacturing – Supply Chain

- Business Extroversion

- Support for Tourism Investments

- Alternative Forms of Tourism

- Large Investments

- European Value Chains

- Entrepreneurship 360o

For the first time, the possibilities provided by the General Exemption Regulation 651/2014 are utilized and relate to the inclusion of investment plans independently, in its other parts besides the aid of regional character. With this initiative, aid in areas such as research and innovation, environmental protection and social – aid such as vocational training for disadvantaged or disabled workers can now be integrated investment plans.

Eligible Expenses

The Eligible Expenses are divided into:

- Eligible expenses of regional state aid nature based on the Regional State Aid Map (capital expenditure in tangible and intangible assets, employment cost of new employees) and

- Eligible expenses of non regional state aid, which aim to broaden and enrich the investment options towards new qualitative directions.

The maximum amounts and percentages of regional state aids and non regional state aids are being determined in accordance with the provisions of the Special Section of the new Law.

Types of Aid

The following types of aid are being provided:

- Grants – Free Provision of Funds by the State for covering partially the aided Investment’s Eligible Expenses

- Subsidy of Leasing by the State, covering part of the disbursed leasing installments for the acquisition of new mechanical and other equipment for a time period not exceeding seven (7) years

- Subsidy of Employment Cost, (Art.2, Par.31 BGER), for employment created by the investment for a time period not exceeding two (2) years

- Tax Exemption up to a certain percentage of the total investment cost and mechanical equipment. The entity can utilize the whole of the entitled aid of tax exemption within fifteen (15) fiscal years from the fiscal year of entitlement of the benefit of use under restrictions that apply cumulatively.

- Fixed Corporate Income Tax Rate for a period of 12 years from the completion of the Investment Project, exclusively for Investment Projects of major funding size

- Funding of Corporate Risk through Funds of Funds

The Types of Aid are granted following a relevant certification, either in lump sum (following the issuance of the decision certifying the completion and the commencement of the productive operation of the project) or gradually (according to the specific requirements per each type of aid granted). All types of Aids – with exception of the Employment Cost Funding – can be provided either separately or in combination thereof and are taken into account for the determination of the total aid amount for each investment project.

Aid Rates

The maximum Aid Rates for regional investments (maximum approved regional aids) are defined by the approved Regional Aid Map.

The Aid Rates are determined according to the size of the Investment Entity, the location of the Project’s implementation and the aid scheme under which the Investment Entity is requesting Aid. Companies are divided in Large, Medium and Small depending on their Size; thus, the allocation of the relevant subsidy and/or other reinforcements is foreseen accordingly by the Law, providing the highest percentages to “Small” entities.

The beneficiaries, the eligible expenses, the type of aids, the percentage of aids, the implementation procedure, as well as the evaluation and audit process are being specifically prescribed per each separate scheme of aid. The new framework provides for increased aid rates for 12 of the country’s 13 Regions. It also includes a special provision that allows for fair transit areas a 10% increase on the percentages that would correspond to them if they were not fair transit areas.

The European Commission adopted the Guidelines on Regional State Aid that it will use to assess the compatibility of all notifiable regional aid awarded or intended to be awarded after 31 December 2021 (hereinafter “RAG”).

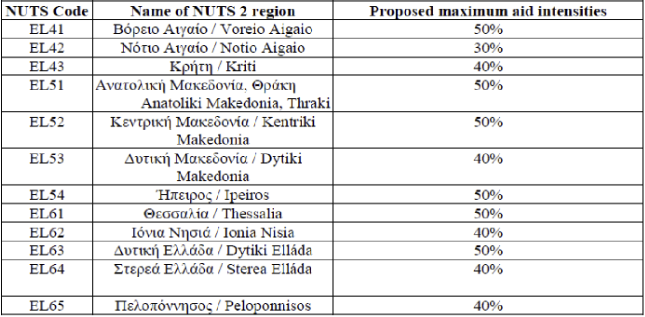

The territory of Greece consists of thirteen NUTS 2 regions. According to Annex I to the RAG, twelve of those NUTS 2 regions are eligible for aid under Article 107(3)(a) TFEU (hereinafter “‘a’ areas”). Greece has been assigned a further coverage of 17.28% of its national population for the designation of areas eligible for aid under Article 107(3)(c) TFEU (hereinafter “‘c’ areas”).

The NUTS 2 regions proposed as ‘a’ areas, for the whole period from 1 January 2022 to 31 December 2027, are presented in Table 1 below. The table also presents the maximum aid intensity proposed for large enterprises for each region.

Filing Applications and Evaluation Process

All procedural issues regarding the support and implementation of the new Law (filing of applications, documentation file, evaluation, etc.) will be carried out through the State Aid Information System of the Ministry of Finance, Development and Tourism.

The evaluation process includes the stage of completion and legality control and the evaluation stage and is carried out either through the method of comparative evaluation or through the method of direct evaluation.

Implementation and Completion of Investment Projects

Investment Projects which fall under the aid schemes are audited at any time and any stage of implementation of the Investment Project and while fulfilling their long term liabilities.

The beginning and completion of operations is certified with the issue of a relevant decision by the competent Institutions as they are defined in Article 17 of the Law.

The Investment Project is completed following the commencement of the productive operation of the investment within the period prescribed in the relevant ministerial decision, which may not exceed three (3) years from the date of issuance of that decision. An extension for two (2) years is also provided, under the following conditions:

- Electronic Submission of the relevant request should take place before the end of the integration period, as it is initially defined in the qualification decision and

- Implementation of 50% of the physical object and 65% of the financial object

For the validation of the beginning of operational function of the investment, documentation of the unit’s operations is required as well as with the creation of at least half of the new jobs defined the qualification decision. The rest of the job positions should be created by the end of the forecasted maintenance period of long-term liabilities.

Special Aid Categories

The Aid Rate is set at 80% of the Regional Aid Map. In order to receive an Aid Rate of 100% of the rate set in the Map, depending on the aid scheme, a company must realize an Investment Project that:

- Will be eligible for submission to the New Business scheme or the Fair Development Transition scheme and/or

- Will be established in a special region defined in a relevant annex of the Law (mountainous, island, border region, region affected by natural disasters) and/or

- Will be implemented in Industrial and Business Areas, Business Parks, Technology Parks and Innovative Activity Hosts and Organized Manufacturing and Business Activity Hosts, provided that they do not concern the modernization or extension of existing structures of the assisted firm and/or

- Will involve the reopening of industrial plants that have ceased to operate. The value of the fixed equipment of the industrial unit to be reopened covers at least fifty percent (50%) of the eligible costs of the Investment Project

Disbursements Flow

- Cash Subsidy

- An amount of up to 25% of the approved grant may be paid to the beneficiary by the execution of 25% of the total investment. The supporting documents are submitted with a certificate – declaration of their correctness by a certified public accountant. The decision of the administration is issued within 20 days from the submission of the relevant request.

- The remaining amount up to 50% or 65% of the approved grant can be paid to the beneficiary upon his request after the certification of the implementation of 50% or 65% of the total cost of the Investment Project by a competent body through on-the-spot or administrative control. The certification is carried out with the issuance of a relevant decision, by the competent bodies of par. 3 of article 17, within 30 days from the submission of the investment audit report or the date of submission of any additional data.

- The remaining amount of the grant or its whole in case of non-application of the above shall be paid further to the issue of the completion decision and commissioning of the Investment.

The amounts of the subsidy are not deducted from the value of the investment costs in order to determine the taxable profits.

Important Note: The subsidy is paid directly through electronic payment to a Bank Account of the Investment Project entity and may not be assigned to third parties. Exceptionally, it is possible to assign the claim to the amount of the grant to banking institutions in order for them to provide short-term loans of an equal amount of cash to that of the grant, used for the Investment Project.

- Leasing Subsidy

The payment of the leasing subsidy may take place after the certification by the relevant monitor installation at the unit of all the leased equipment, according to the leasing contract.

The subsidy is paid every six months and after each payment of the rent installments on behalf of the investor. The amount payable is calculated on the equipment acquisition value, which is included in the paid installments in accordance with the approved aid rates and with the limitation of not exceeding the payment of sixty percent (60%) of the approved amount until the decision of completion and the beginning of productive operations of the investment project.

In advance payoff by the investment entity is possible, only for the last twelve (12) months of the lease contract, as approved by the relevant department.

The amounts of the leasing subsidy are not deducted from the value of the investment costs in order to determine the taxable profits.

III. Tax Relief – Exemption

The right to begin using the utility incentive of tax exemption is based on the certification of implementation of 50% or 65% of the cost of the project by the competent control body. The entity can utilize the whole of the entitled aid of tax exemption within fifteen (15) fiscal years from the fiscal year of entitlement of the benefit of use under specific conditions that apply accumulatively.

The yearly spent amount of the tax exemption appears in a specific reserve and a corresponding account in the Company’s books, formed from income tax which was not paid because of the provided tax exemption.

- Subsidy of Employment Cost

The starting point of the subsidy of employment cost can take place after the certification by the competent inspection body of the creation of associated with the investment project jobs.

The subsidy is paid every six months and after each payment of wage costs on the part of the investor, with the limitation of not exceeding the payment of sixty percent (60%) of the approved amount until the issue of the completion decision and the beginning of productive operation of the investment.